Amortization refers to the process of paying off a debt (often from a loan or mortgage) over time through regular payments. A portion of each payment is for interest while the remaining amount is applied towards the principal balance. The percentage of interest versus principal in each payment is determined in an amortization schedule.

How Mortgages Work - 1

Negative amortization only occurs in loans in which the periodic payment does not cover the amount of interest due for that loan period. The unpaid accrued interest is then capitalized monthly into the outstanding principal balance. The result of this is that the loan balance (or principal) increases by the amount of the unpaid interest on a monthly basis. The purpose of such a feature is most often for advanced cash management and/or more simply payment flexibility, but not to increase overall affordability.

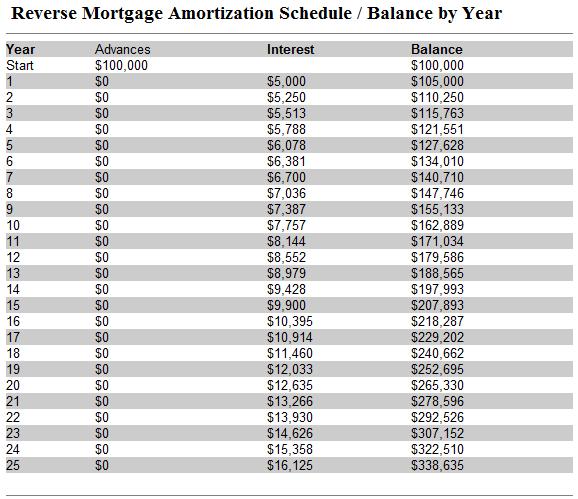

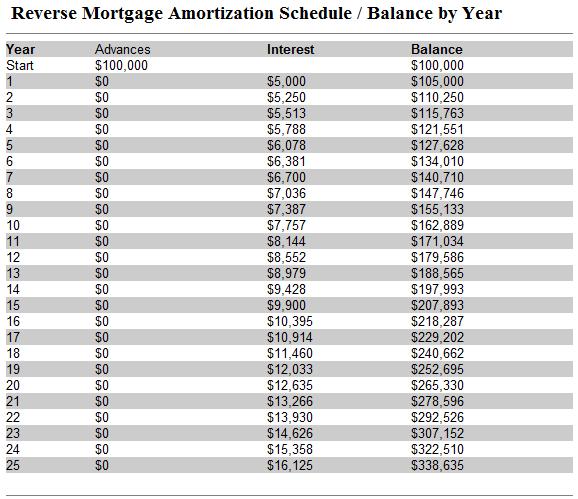

Reverse Mortgage Amortization

Neg-Ams also have what is called a recast period, and the recast principal balance cap is based on Federal and State legislation. The recast period is usually 60 months (5 years). The recast principal balance cap (also known as the "neg am limit") is usually up to a 25% increase of the amortized loan balance over the original loan amount. States and lenders can offer products with lesser recast periods and principal balance caps; but cannot issue loans that exceed their state and federal legislated requirements under penalty of law.

A reverse mortgage converts

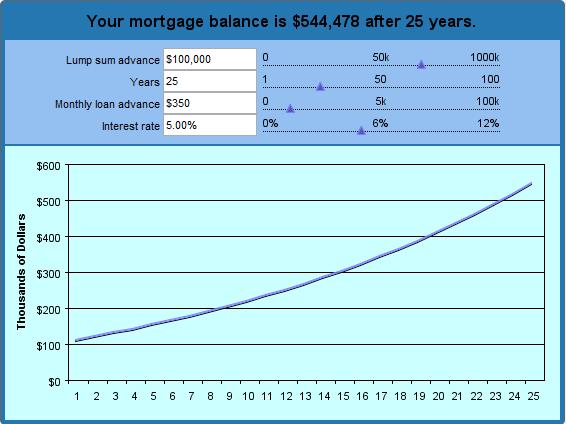

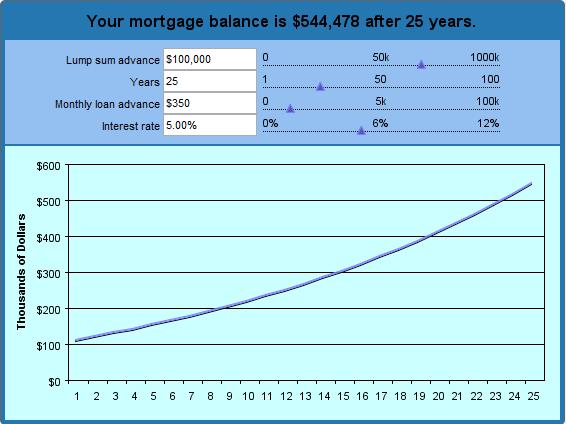

Reverse Mortgage Calculator

Amortization Mortgage Reverse 20 Jumbo Reverse Mortgage Rate Calculator

Reverse Mortgage Amortization

Utilizing a Reverse Mortgage

Amortization Mortgage Reverse 20 California Reverse Mortgage Rancho Corcova

Amortization of Reverse Mortgage. Document Sample

Excel Reverse Mortgage Amortization Formulas document sample

How Mortgages Work - 1

Negative amortization only occurs in loans in which the periodic payment does not cover the amount of interest due for that loan period. The unpaid accrued interest is then capitalized monthly into the outstanding principal balance. The result of this is that the loan balance (or principal) increases by the amount of the unpaid interest on a monthly basis. The purpose of such a feature is most often for advanced cash management and/or more simply payment flexibility, but not to increase overall affordability.

Reverse Mortgage Amortization

Neg-Ams also have what is called a recast period, and the recast principal balance cap is based on Federal and State legislation. The recast period is usually 60 months (5 years). The recast principal balance cap (also known as the "neg am limit") is usually up to a 25% increase of the amortized loan balance over the original loan amount. States and lenders can offer products with lesser recast periods and principal balance caps; but cannot issue loans that exceed their state and federal legislated requirements under penalty of law.

A reverse mortgage converts

Reverse Mortgage Calculator

Amortization Mortgage Reverse 20 Jumbo Reverse Mortgage Rate Calculator

Reverse Mortgage Amortization

Utilizing a Reverse Mortgage

Amortization Mortgage Reverse 20 California Reverse Mortgage Rancho Corcova

Amortization of Reverse Mortgage. Document Sample

Excel Reverse Mortgage Amortization Formulas document sample

No comments:

Post a Comment